Global direct view LED video display shipments increases

EP&T Magazine

Electronics Optoelectronics Supply Chain optoelectronics trendsOmdia research finds 18.5% year over year in 3Q23

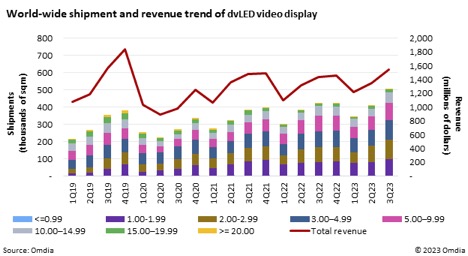

Global shipments for the direct view LED market grew by 23.1% quarter-over-quarter (QoQ) in the third quarter of 2023 and by 18.5% year-over-year (YoY), according to Omdia’s latest LED video display market tracker 3Q23.

However, inflation has hindered revenue results, with global revenue reporting an increase of only 13.9% QoQ and 7.7% YoY from 3Q23. “End-users and system integrators affected by inflationary pressures downgraded their choices to cheaper products in their class, or chose wider pixel pitch products at a lower price, while compromising on achieving higher resolution,” said Tay Kim, Senior Principal Analyst at Omdia. “In fact, fine pixel pitch products of 2mm or less only grew by 18% YoY for third quarter results in 2023, while the wider indoor product line of 2~4.99mm showed a higher growth rate of 29% YoY,” added Kim.

Source: Omdia

Direct view LED video display shipment trends vary

China showed negative growth in the second half of 2022 due to the Chinese government’s zero-COVID policy. However, China succeeded in rebounding this year, growing by 23.4% QoQ and 23.6% YoY in the third quarter of 2023.

In other regions, high inflation levels have slowed the growth rate considerably. Europe’s impact from inflation was relatively high, and suffered a decline of 2.1% YoY, in addition to low price competitiveness compared to LCD.

On the other hand, North America maintained a stable industry despite inflation due to the advantage of its base currency and showed relatively high growth of 15.7% YoY. In Asia & Oceania, increased demand in India helped boost the region’s overall shipments, with relatively high growth of 20.5% YoY.

Sales of products using COB technology are increasing

Initially, the barrier to entry for producing and selling COB products was relatively high because initial costs and design technology on a PCB board were required to set up the production process in the past. However, technology and production capacity improvements of Chinese OEM brands such as MTC and HCP expanded within the past year, allowing major brands to enter the market and offer COB type direct view LED video products in their display portfolio. COB technology can achieve improved quality compared to SMD technology in terms of screen uniformity, durability, heat generation, and power consumption management. Additionally, the price gap has narrowed as well compared to SMD technology, attracting more brands and end-users. In fact, according to Omdia’s latest LED video display market tracker 3Q23, COB technology grew 31.2% YoY in the third quarter of 2023, while SMD technology grew only 17.9% YoY.

All-in-one direct view LED video display shipments also increasing

All-in-one (AIO) direct view LED video displays have the flexibility to create larger sizes and various aspect ratios compared to LCD products. However, the resolution is generally lower than that of LCDs, and it is difficult to implement highly sensitive touch functions due to production specialties. Demand for AIO dvLEDs are rapidly growing as these displays monopolize the 110-inch and larger area, with LCD offerings limited in this size range. Currently, the largest shipment in the AIO dvLED display market is the 1.5~1.7mm pixel pitch product line that forms FHD in the 130~140-inch range. A 110-inch UHD product that can compete directly with LCD in terms of resolution has been commercialized, but shipments are still minimal due to the high price. Shipments of AIO dvLED product lines increased rapidly since the second half of 2021, growing at a rate of 57.4% YoY in the third quarter of 2023 according to Omdia’s LED video display market tracker 3Q23.

As price competitiveness of the overall dvLED product line improves in the future, direct rivalry with LCD based on resolution is expected to intensify, especially in the corporate and conference room market. Therefore, dvLED is expected to drive further growth of the entire digital signage display market with a high growth rate in the future.