NA pcb industry sales jump

EP&T Magazine

Electronics Production / Materials Supply Chain boards Circuit pcb pcba printedIPC report indicates revenues up 7.7% in January

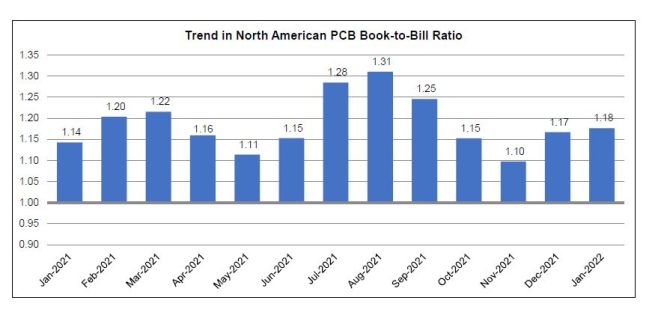

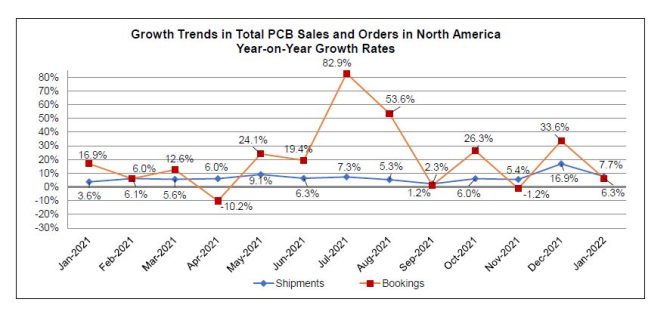

Things are looking ‘up’ for the printed circuit board (pcb) market in North America, according January findings by the IPC group’s Statistical Program. The book-to-bill ratio stands at 1.18, while total North American pcb shipments in January 2022 were up 7.7 percent compared to the same month last year. Compared to the preceding month, January shipments fell 22.1 percent.

Year-to-date pcb bookings in January were up 6.3 percent compared to last year, says the IPC, while bookings in January fell 28.1 percent from the previous month.

“Supply chains are showing some early signs of improvement, which is helping fuel shipment growth at the start of the year. But backlogs remain higher as manufacturers work through strong orders,” says Shawn DuBravac, IPC chief economist. “We believe supply chain constraints will continue to slowly ease through the remainder of the year which should help companies improve shipment schedules.”

Source: IPC

Detailed data available

Companies that participate in IPC’s North American pcb Statistical Program have access to detailed findings on rigid pcb and flexible circuit sales and orders, including separate rigid and flex book-to-bill ratios, growth trends by product types and company size tiers, demand for prototypes, sales growth to military and medical markets and other timely data.

Source: IPC

Interpreting the data

The book-to-bill ratios are calculated by dividing the value of orders booked over the past three months by the value of sales billed during the same period from companies in IPC’s survey sample. A ratio of more than 1.00 suggests that current demand is ahead of supply, which is a positive indicator for sales growth over the next three to twelve months. A ratio of less than 1.00 indicates the reverse.

Year-on-year and year-to-date growth rates provide the most meaningful view of industry growth. Month-to-month comparisons should be made with caution as they reflect seasonal effects and short-term volatility. Because bookings tend to be more volatile than shipments, changes in the book-to-bill ratios from month to month might not be significant unless a trend of more than three consecutive months is apparent. It is also important to consider changes in both bookings and shipments to understand what is driving changes in the book-to-bill ratio.

IPC’s monthly pcb industry statistics are based on data provided by a representative sample of both rigid pcb and flexible circuit manufacturers selling in the USA and Canada.

IPC publishes the pcb book-to-bill ratio by the end of each month.