Costs of OLED TV displays catch up to LCD panels

EP&T Magazine

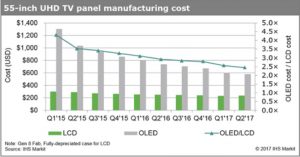

Electronics Optoelectronics Engineering Supply Chain OLED displaysUnit cost for 55-inch UHD OLED TV panels recorded a 55 percent decline in second quarter of 2017 since its introduction in early 2015, IHS Markit says

A major decrease in manufacturing cost gap between organic light-emitting diode (OLED) display and liquid crystal display (LCD) panel is expected to support the expansion of OLED TVs, according to new analysis from IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

The OLED Display Cost Model analysis estimates that the total manufacturing cost of a 55-inch OLED ultra-high definition (UHD) TV panel — at the larger end for OLED TVs — stood at $582 per unit in the second quarter of 2017, a 55 percent drop from when it was first introduced in the first quarter of 2015. The cost is expected to decline further to $242 by the first quarter of 2021, IHS Markit said.

The manufacturing cost of a 55-inch OLED UHD TV panel has narrowed to 2.5 times that of an LCD TV panel with the same specifications, compared to 4.3 times back in the first quarter of 2015.

“Historically, a new technology takes off when the cost gap between a dominant technology and a new technology gets narrower,” said Jimmy Kim, principal analyst for display materials at IHS Markit. “The narrower gap in the manufacturing cost between the OLED and LCD panel will help the expansion of OLED TVs.”

However, it is not just the material that determines the cost gap. In fact, when the 55-inch UHD OLED TV panel costs were 2.5 times more than LCD TV panel, the gap in the material costs was just 1.7 times. Factors other than direct material costs, such as production yield, utilization rate, depreciation expenses and substrate size, do actually matter, IHS Markit said.

The total manufacturing cost difference will be reduced to 1.8 times from the current 2.5 times, when the yield is increased to a level similar to that of LCD panels. “However, due to the depreciation cost of OLED, there are limitations in cost reduction from just improving yield,” Kim said. “When the depreciation is completed, a 31 percent reduction in cost can be expected from now.”

The OLED Display Cost Model by IHS Markit provides more detailed cost analysis of OLED panels, including details of boards, arrays, luminescent materials, encapsulants and direct materials such as driver ICs. The report also covers overheads such as occupancy rate, selling, general and depreciation costs. In addition, this report analyzes OLED panels in a wide range of sizes and applications.