Component shortages: What this means for the product design industry?

By Titu Botos, co-founder & CEO, NeuronicWorks Inc.

Electronics Engineering Supply Chain component Covid 19 design Editor Pick engineering supply ChainCOVID-19 pandemic has exacerbated supply chain disruptions and production issues

News on the global chips and components shortage has been doing the rounds from the last couple of months and the consequence of the shortage is now being felt by every link in the supply chain. Though the affects of the shortage were felt from as early as 2018, the COVID-19 pandemic has exacerbated the situation with supply chain disruptions and production issues.

The pre-pandemic shortage was created by the sharp increase in components demand by the automotive industry and the growth of IoT applications in general. The automotive industry has been including smarter electronic systems in vehicles including infotainment systems, navigation and steering support, advanced driver assistance systems (ADAS) and autonomous vehicle software. IoT applications spanning industries continues to grow adding sensors and wireless communication to diverse, innovative applications, hence increasing the demand for an entire slew of electronic components.

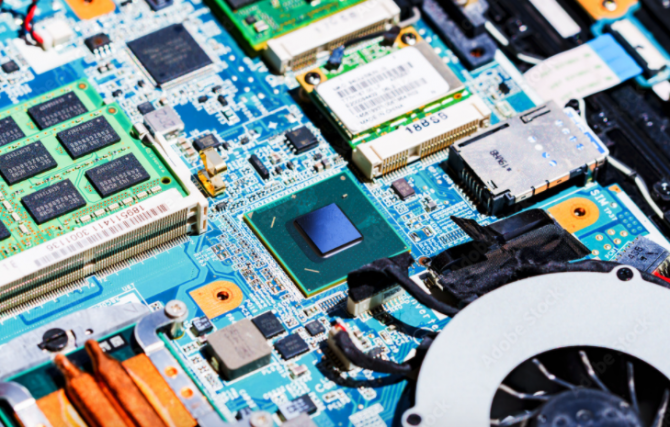

Source: Adobe Images

What started with a blow to the automotive industry is now affecting the consumer electronics industry. When the pandemic first hit, and movement became restricted, the demand for automobiles went down and the demand for personal devices rose dramatically with offices, schools and universities going into a virtual mode. Component suppliers pivoted to supplying surging demand for consumer electronics like laptops, personal devices, gaming devices, etc. and for the healthcare industry with critical demand for ventilators, X-ray machines, medical diagnostic tools, etc.

Now component manufacturers are starting to shift back to pre-COVID operations but are still plagued with an increasingly fragile and long supply chain. And this presents a challenge for product development and manufacturing companies of all and any devices that uses semiconductor components.

What is causing the component shortage?

The disruption in semiconductor availability is the result of a confluence of factors from across the globe. This includes unfavourable weather conditions in Texas, severe drought in Taiwan, a factory blaze in Japan, in addition to extreme changes in customer buying behaviour brought about by the pandemic. Add to this, global wide shutdowns of facilities due to the pandemic further exacerbated production bottlenecks.

Global effects of components shortage

According to World Semiconductor Trade Statistics Organization figures, after a decline in 2018 and 2019, the global semiconductor sales revenue grew by 6.5% in 2020, to $439 bn. This trend is a testament to increasing pressures on component supply chains driven by COVID-19 demand.

The increasing demand has led to the global industry’s reliance on a small group of foundries in Taiwan and South Korea for leading-edge chips. Add to this, the trade wars tension between US and China and the sanctions imposed on Chinese foundries have also led to additional stress on Taiwan and South Korean foundries’ capacities.

A recent report from Goldman Sachs states that the shortage of semiconductor chips has impacted 169 industries across the board, which could last well into 2022. According to the report, the worst hit industries are consumer focused like automobiles and consumer electronics. Though it is interesting to note that the demand for consumer electronic devices like smartphones, laptops and tablets bolstered by the pandemic have been met over the last couple of months, which can help balance supply and demand to a certain extent.

Components Shortage: More issues

Hoarding

Shortage of components leads to another concerning behaviour of hoarding and stockpiling through inventory accumulation, safety stock building and double ordering. Foundries can find it extremely difficult to differentiate demand from hoarded product and hoarding can distort the demand signals currently impacting the supply chain, giving out wrong signals and making demand inflated.

Component Allocation

Allocation is a special situation when demand for components exceeds manufacturing capacity. As suppliers do not receive sufficient components from manufacturers to fulfil customer needs, suppliers are forced to allocate partial quantities and schedule deliveries over a period of time. Allocation also means that lead times are much longer and uncertain. Broadcom, for example, is one such chip manufacturer that is now assigning allotments to their customers regardless of demand to try and balance the situation. Leading component manufacturers are asking for forecasted usage and advance Purchase Orders projected till the end of 2022.

Fake Components

As with most other high demand commodities, there is a fear of fake or counterfeit chips that are making its way into the market. While not necessarily affecting tech giants who have robust supply chains and who typically will only purchase directly from reputable chip manufacturers, the low-volume manufacturers with less established supply chains are more at risk. These smaller companies usually use the services of third-party distributors who could be buying and selling components from different places including online open markets which opens the risk to fake and counterfeit components. Many of these smaller distributors service the healthcare, automotive and defense industries.

Components Cost

As the demand is higher than supply, component prices are soaring. We have experienced situations where components were charged six to ten times their ‘regular’ price. Manufacturers with deeper pockets can afford to pay a premium to ensure their lead times are maintained, but this is not the case for everyone. The inflated price that is being paid for the components may ultimately have to spill over to the end user which is currently being reported.

Boosting Domestic Chip Manufacturing

Diversifying the manufacturing base is a crucial step to overcoming disruptive supply chains. Developing regional manufacturing and distribution hubs can help close the large supply gap and can minimize the risk of expensive delays in production and reduced lead times. Today, the vast majority of the world’s electronic components are made in China, while the U.S. is the second biggest producer.

Reshoring or onshoring sentiment is growing in popularity across industries as manufacturers face lesser risk by spreading manufacturing capacity over a broader geographic region and enjoying reduced tariffs. There is also a decreased risk of cybersecurity threats, and considerably lower transportation costs.

How can Product Developers help?

While developing a product, there are typically two scenarios that can play out:

- New Product Development: building and planning for a completely new product.

- Product Update/Maintenance: updating a product with new technology or replacing legacy technology.

Both of the above scenarios have their own challenges, but the former is the one under most of the pressure. The issue here is the length of time between the design stage (where ideal components are selected) and the start of manufacturing. The longer the time between these two stages, the greater is the risk of being affected by components availability and cost variation.

For any product that requires hardware components, we advise our clients to prepare for a component shortage challenge given the fact that larger companies and manufacturers have bigger purchasing power and are currently resorting to stockpiling. To be better prepared, here is what we advise:

- Plan in advance: Work with your design firm to understand the components required for both prototyping and the various stages of production. Design houses usually have longstanding partnerships with key component manufacturers, vendors and distributors and can help to quickly identify and source the right components needed to meet the project goals.

- Drop-in replacements: Ask your design house to look for alternate options for components that are not too critical. Having a list of vendors that offer drop-in replacements prepared in advance, can help reduce the risk of component shortage while moving into production build.

- Purchase in advance, blanket orders: As soon as the product design is finalized, tested and validated, place purchase orders for mass production. Even if it will be a couple of months before production at scale starts, it will be smart to have the necessary stock in place.

- Redesign and Development: Another alternative to replacing components is redesigning and redeveloping the product to optimize for available components.

Work closely with your design house to navigate the challenges of global component shortages and find the right solution (both for design and obsolescence management) to keep your product plan on schedule.

With the domino affect of the shortage, the future seems uncertain, and most industry analysts are adopting a wait and watch policy to see how this trend will unfold. But one thing is certain, diversifying the semiconductor manufacturing base is imperative to building a reliable global supply chain.

—————————————-

Titu Botos is co-founder and CEO of NeuronicWorks Inc., a product design and custom engineering company based in Ontario. https://neuronicworks.com