Component supply chains continue to be disrupted

By Jeff Newell, senior vice-president of products at Mouser Electronics

Electronics Engineering Supply Chain components distribution engineering sourcing supply ChainElectronics design ecosystem remains resilient

As supply chain disruption continues to befall the electronics industry globally and – of course – closer at home here in Canada – electronic engineering teams struggle in their journey to obtain necessary components required to achieve end-designs.

Shortages across all product categories, rising part prices, questionable lead-times, time-to-market pressures are compounding the challenges within the field of assembling an electronic application these days. To delve deeper into the topic of supply chain within the electronic component arena, EP&T took the opportunity to discuss many of these various issues with Jeff Newell, senior vice-president of products at Mouser Electronics.

Q. Is there any way to predict disruptions in the supply chain, which way to relate to transportation, positive or negative demand shocks and production issues?

While some predicted the global pandemic would disrupt supply chains across many industries, it was most definitely worse than projected. Still, the electronic component industry continues to show positive growth. For 2022, the Semiconductor Industry Association (SIA) is projecting growth of about 8.8%. As for predicting further disruptions, we do our best to anticipate demand. For Mouser, our strategy to invest in inventory regardless of business conditions has allowed us to grow and be well positioned for the future ahead.

Q. As we emerge from the first quarter of 2022, do you anticipate lead times will increase?

Lead times are showing small signs of improvement, however we do expect supply chain instability and inflationary pressures to persist for the rest of 2022. Customers are placing orders many months ahead, and the industry outlook shows robust demand for semiconductors and electronic components, particularly in the data, communication and transportation sectors. At Mouser, our inventory position and wide selection continues to set us apart.

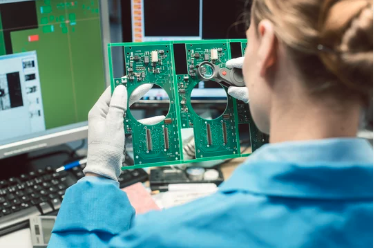

Source: Adobe Images

Q. What about the outlook on potential price increases on such component staples as analog, complex semiconductor (ASICs, MCUs, MPUs, PLDs), flash memory, non-ceramic capacitor, resistor and standard logic devices.

We expect continued price increases for products that remain in high demand. For products where lead times are getting back to normal it’s possible that pricing will stabilize. Of course, we are doing what we can to keep prices from increasing through strategic purchasing, product selection, and working directly with our manufacturers to minimize any impact for our customers.

Q. How does component demand compare this spring versus the spring periods of 2020-21?

Business continues to be strong. Customers are naturally frustrated by the product shortages and are placing orders ahead. Distributors are not immune to global factors and there have been extended lead times and restricted allocation. Our Product teams are closely monitoring and working with manufacturers to restock products as needed. Innovation is still happening and some of major growth drivers are 5G, artificial intelligence, robotics, industrial automation and transportation.

Q. Are active components more constrained than passive components? Do they both suffer from raw material challenges?

We have seen shortages across all product categories. Passive lead times are improving and we expect lead times for active products to improve over the next few quarters. Of course, inventory and selection are key in times of shortages. Last year, Mouser added a record 100-plus new manufacturers to our lineup, and we stock the industry’s widest product selection. Still, we are not immune to global factors and there have been extended lead times and restricted allocation due to shortages of products and raw materials.

Q. What tips would you provide to engineering teams to help keep design projects on track and minimize the effects of supply chain disruptions? What resources do you offer?

Having real-time information and inventory is key. Our website shows availability of stock and lead times on products. Customers can order products and get on a waiting list to receive stock once available. We can suggest product alternatives if needed.

It’s really important to continue using authorized sources and genuine products for design, even with extended lead times, as this can prevent problems down the road. We are a go-to resource for engineers and buyers, whether it’s to purchase new products or ask technical questions. Our extensive online library of services and tools and technical resources, includes a Technical Resource Center and content hub, along with product data sheets, supplier-specific reference designs, application notes, technical design information and engineering tools.

Q. Contract electronics manufacturing are facing increased pressure to meet unprecedented demands. Customers need lower costs, increased scope of services, and faster turn times – at the same time as lead times a climbing. What advice would you give to CEMs and EMS players today.

There’s no question that customers are feeling time-to-market pressures, plus we are seeing inflation impact our industry. Working with a reputable, well-resourced, authorized distributor is essential. We work closely with our 1,200+ manufacturer partners to provide the fastest and easiest access to the industry’s newest components. Having the most advanced technology to develop cost-efficient prototypes limits costly redesigns, manufacturing delays or even the termination of a project. It also leads to a design edge in delivering more product features and capabilities, as well as longer lifecycles.

Q. More than before, component buyers are contemplating purchase of aftermarket parts, which is encouraging counterfeiters to be bold. How important is it for designers to take measures to protect themselves accordingly.

Definitely now more than ever, it is crucial to obtain genuine parts from authorized sources, confident that they are 100% certified and fully traceable from each manufacturer. Design engineers should be careful when buying from an unauthorized source. The risk of being supplied with counterfeit or grey market products is high — and it is impossible to know where that product has come from, how it is has been handled, and how it will perform. Counterfeit products can lead to unexpected failures, quality and warranty issues.

Jeff Newell, senior vice-president of products at Mouser Electronics.