In home connected devices climb in U.S.

EP&T Magazine

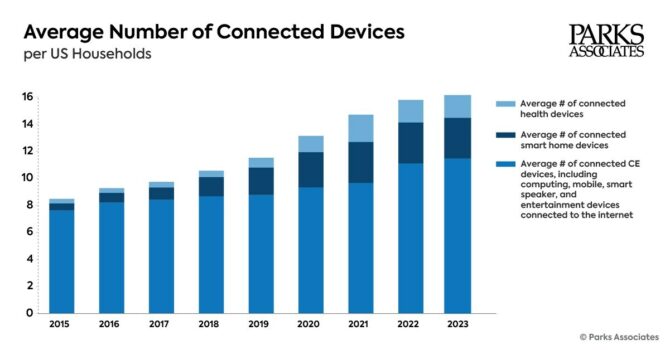

Electronics Supply Chain consumer devices Electronics home Internet smartParks Associates research showing average number per US Internet household reached 17 in 2023

The average number of connected devices per US internet household reached 17 in Q3 2023, according to new research released by Parks Associates at CES 2024. The information was generated from the research group’s quarterly consumer survey of 8,000 US internet households, finding the average number of connected devices per US internet household reached 17 in Q3 2023.

Parks Associates’ Consumer Electronics Dashboard, an ongoing service that visualizes the most important metrics for consumer electronics (CE) devices in the home, also notes that for the first time, smartphone ownership surpassed TV ownership, with 90% of households reporting ownership of a smartphone compared to 88% with a TV.

Parks Associates

“Smartphones are ubiquitous now, and connected consumer electronics such as wireless earbuds, tablets and smart TVs are commonplace,” said Sarah Lee, research analyst, Parks Associates.” Today, these devices are essential for entertainment purposes and daily personal communications, which can include school, work and family. This necessity drives continued purchases, as every year CE companies roll out innovative and advanced models that drive the consumer desire to upgrade.”

Parks Associates recently released its list of industry trends for 2023. The firm reports that 92% of US households have fixed or wireless internet service at home. Among these US internet households:

66% have a smart TV

42% have at least one smart home device

31% have a security system

39% have a smart watch

89% have a streaming video service

The research finds consumer spending demonstrates remarkable resilience. After a brief pause early in 2023, consumers’ enthusiasm for consumer electronics products rebounded at the end of the year. Purchase intentions for popular entertainment devices such as gaming consoles, streaming media players, and VR headsets have increased compared to 2022 and now resemble 2021 levels, which was the height of the pandemic.

“Economic conditions and fear of a recession previously stalled purchases of CE categories,” Lee said. “But higher intentions to purchase are likely a reflection of prolonged delayed gratification, the end-of-year holiday season, enticing retail promotions, and hope for continued economic improvement in 2024.”