Computing hardware for AI continues to deepen impact

Stephen Law

Automation / Robotics Electronics AI AI artificial artificial intelligence intelligenceAI expected in smartphones and to profoundly impact semiconductor industry

Without a doubt, the impact of artificial intelligence (AI) within electronic ecosystems in the coming years remains immense, according to an AI technology & market research report by Yole Développement.

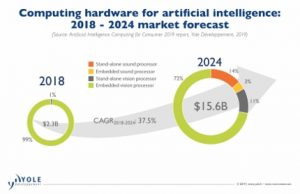

Yole analysts estimate the 2024 total market for hardware computing for consumer applications to reach US$15.6-billion. This market can be shared between two market segments: the stand-alone chip at US$ 3.8 billion and the embedded one, especially supported by the smartphone, up to US$11.8 billion.

The Yole report identifies numerous and impressive consumer applications to be impacted, such as biometrics, surveillance, photography, remote control, and virtual assistant.

“In recent years, we are seeing the emergence of edge computing”, says Yohann Tschudi from Yole. “And this trend involves placing the calculation at the system level. However, the constraints are strong: always-on, consumption and performance in particular.”

Report evaluates the AI impact

Aim of this analysis is to reveal an AI scenario with dynamics of the consumer industry. The report evaluates the AI impact on the semiconductor industry and proposes an in-depth understanding of the AI ecosystem and related players. Yole’s analysts have anticipated for a few years now the move from the cloud to the edge. Today transition is happening faster than ever, especially within the imaging market segment. Facing this disruption, AI algorithms require powerful hardware.

With the end of Moore’s law and the need for power demanded by AI algorithms, it was necessary to create a new type of dedicated architecture. This unit has different names: deep learning accelerator, neural engine, neural processing unit, AI-processing unit. The goal is the same: to allow, without the need of a power-hungry GPU , to parallelize calculations very numerous in deep learning algorithms, and thus bring intelligence directly to the device level, independent of the cloud. Yole’s report distinguishes two types of technologies: either the AI is entirely dedicated to the analysis due to a stand-alone chip, or the unit dedicated to this task is embedded in a SoC whose objective is not centered on the analysis. To name a few examples, on the one hand, for the stand-alone chip, Intel Movidius is a perfect example. On the other hand, an “application processor”, like Qualcomm’s Snapdragon series, which is the central chip of smartphones containing a neural engine are representative of the embedded category.

Actors are different for each type of computing hardware

“For each type of computing hardware, the actors are different and specialized”, explains John Lorenz, Technology & Market Analyst, Computing & Software at Yole.

Even if the IP players propose solutions for the whole ecosystem, it is obvious that there is a strong stake to bring the calculation close to the sensor or centralize it in a multifunction chip. In the first case, Yole finds the historical actors as well as the suppliers of sensors who want to add value to their product: for example, ON Semiconductor, Ambarella, TI, Sony, Knowles, ams. On the other more and more OEMs also wants to capture this value by designating their own chip. Apple, Samsung, Huawei (with HI Silicon) and more famous players such as Intel or Qualcomm are part of this ecosystem. The latter stands out by offering this type of computing for other markets than the smartphone such as virtual personal assistant, drones or smart camera. At the top of the pyramid, the tech giants are also designing their own hardware, especially at the level of cloud computing where the value is even stronger and the clear objective of the data, today equivalent to a currency, different.