Making certain that passive distribution channels have the necessary robustness

By Mike Green, technical contributing editor, Transfer Multisort Elektronik

Electronics Engineering capacitors ceramic MLCC multi-layerAdmittedly, it is ICs that will get the majority of attention when it comes to electronic system design, with the supporting passive components too often receiving very little of the limelight. Nevertheless, their value should certainly not be underestimated.

The passives incorporated into electronic hardware have important roles to play when it comes to ensuring that the performance levels expected are actually delivered, and providing all the necessary functionality. If a specific component – no matter how small or inexpensive it may be – cannot be sourced in an acceptable timeframe, then it could have a major impact on the OEM’s production process. Existing order obligations may consequently not be fulfilled and prospective windows of opportunity might end up being missed.

Production workflows caused by the COVID

Over the last 18 months, the global electronics supply chain has been through what is widely considered to be the most challenging period in its entire history. The component shortages that were already starting to be witnessed got further exacerbated by interruptions in production workflows caused by the COVID-19 pandemic.

An area that was subject to long lead times even before the arrival of COVID-19 was multi-layer ceramic capacitors (MLCCs). After a prolonged lull in demand back in late 2018 and early 2019, many manufacturers dramatically curtailed their production capacity. Since then, however, market dynamics have brought these components back into favour – with unprecedented volume requirements now being witnessed.

A report from Mordor Intelligence [1] expects that the worldwide MLCC market, which was worth $10.3 billion in 2020, will have surpassed $15 billion by 2026. That constitutes a 5.42% compound annual growth rate (CAGR) over that period. Among the sectors that are driving demand are 5G smartphones, electric vehicle (EV) powertrains, and renewable energy generation systems.

E-mobility and its implications

The number of EVs on our roads is set to increase substantially during the next few years – thereby allowing society to alleviate the issues caused by carbon emissions (in relation to climate changes) and NOx (with regard to the damage this does to people’s health). If projections by the International Energy Agency (IEA) are proved right, there will be at least 145 million registered EVs by 2030 [2]. The advent of faster charging infrastructure will shorten the period in which EV batteries can be replenished. At the same time, the ramping up of the voltages used in EV powertrains will help to increase efficiency levels, so that greater distances can be traveled between charges. Though both of these innovations seem certain to help raise the popularity of EVs, the high voltages needed for them to be realized are going to put extra strain on the circuitry involved, leading to greater use of passive components. The EV models now coming on to the market can feature over 10,000 MLCCs, so the overall volumes that are going to be called for will undoubtedly be immense.

Targeted at EV usage, KEMET’s KC-LINK™ capacitors have a proprietary C0G/NPO base metal electrode (BME) dielectric system that means these components present very high degrees of ruggedness. They are well suited to use in EV traction inverters and onboard chargers.

Figure 1: An example of an ALA7D capacitor from KEMET

With standard capacitance values of up to 900µF, the Kyocera AVX FHC series capacitors rely on a dry-wound segmented metalized polypropylene construction. These components are optimized for DC filtering across EV powertrains, so the presence of voltage ripples can be addressed. They offer elevated dielectric strengths across a working temperature range that goes all the way to 115°C.

Figure 2: The FHC series capacitors from Kyocera AVX

5G mobile communications

To achieve higher data rates and greater data volumes promised by 5G networks, higher frequency bands (in the mmWave region of the RF spectrum) are being employed alongside the more established frequencies. The upshot of this is that higher-value capacitors and lower-loss magnetics will be in ever greater demand.

Figure 3: KEMET’s CBR series MLCCs

Based on BME technology, Kemet’s CBR series of capacitors are a popular choice for next-generation mobile communication infrastructure. Covering capacitances from 0.1pF up to 100pF, and packaged in a variety of different case sizes (from 0201 to 0805), these MLCC components can be used at frequencies going from 1MHz right up to 50GHz. They have strong self-resonance characteristics, as well as low equivalent series resistance (ESR) values that minimize power losses.

IoT infrastructure

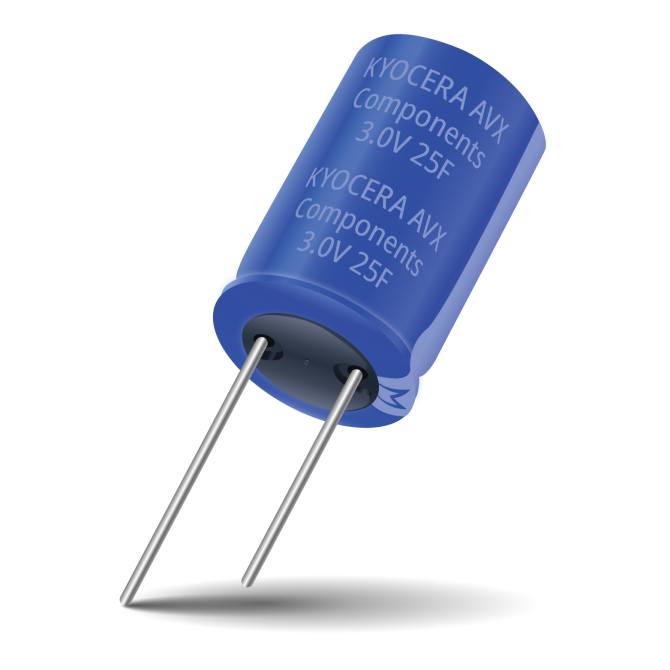

Huge numbers of IoT nodes, counted in the tens of billions, are expected to go into operation over the course of the coming years, in order to support industrial automation implementations and smart city initiatives. This will drive demand for super-capacitors, as these can be used for energy harvesting purposes – storing the energy captured from the ambient environment by photovoltaic cells, thermal-electric generators (TEGs), etc. This will mean that costly and logistically-challenging battery replacement work can be avoided. SCC series cylindrical super-capacitors from Kyocera AVX exhibit industry-leading pulse power handling properties. They have very high capacitance levels (reaching up to 3000F) plus ultra-low ESR (15mΩ maximum at 1kHz for a 100F version) and very little leakage current.

Figure 4: Kyocera AVX’s SCC super-capacitors

Redefining the passive supply chain

Facing a lack of available inventory, OEMs are currently being placed under incredible pressure. Ways need to be found to mitigate supply shortages and reduce the lead times involved. To do this OEMs must start working more closely with their distribution partners.

Moving forward, the ‘just in time’ manufacturing culture that has built up over the last decade will no longer be applicable. Instead, the engineering and purchasing departments of OEMs will need to be much better prepared. This will mean that they can avoid the risk of having to make unwanted changes to product designs, due to required quantities of a constituent component being too difficult to obtain – and not be hit by the heavy expense associated with such undertakings.

If they have greater visibility of what their passive requirements are likely to be in the medium and longer-term, then they can successfully plan ahead. Also by entering into consultation with their preferred distributor, they will be made aware of industry trends that are emerging, as well as any geographic demand hotspots that could detrimentally affect supplies of particular components.

Prototyping a new product concept

Conversely, distributors need to be able to use their understanding of the market and key applications to identify where demands are likely to be at their most acute. By doing so, they can then ensure that they stock appropriate quantities of component parts for them to keep up with their customers’ requirements. Also, if a certain component is going to be difficult to source, they must use their expertise to advise what the potential alternatives might be.

By engaging with the team at TME, customers can select and procure the passive components needed for their equipment – whether it is the small volumes needed when prototyping a new product concept, or maintaining the volume production of an existing product. Thanks to ultra-efficient operations and high-capacity logistic centers stocking huge quantities of inventory, the company can provide assured ongoing supply chain integrity (with close to 300,000 products being offered).

Conclusions

The electronics industry has always been in a state of perpetual flux, with it never standing still but always progressing and adapting. Exciting new applications are continuously appearing on the horizon and component parts need to be selected that will support them. Though much of the engineering focus is on the high-end active devices, it is often the commodity passive components where the procurement problems are at their greatest. The MLCC shortages that OEMs have been forced to deal with in recent times underline this point. They show the importance of establishing effective supply channels to combat the build-up of bottlenecks.

——————————-

References

[1] https://www.mordorintelligence.com/industry-reports/multi-layer-ceramic-capacitor-mlcc-market

[2] https://www.iea.org/reports/global-ev-outlook-2021/prospects-for-electric-vehicle-deployment