Semiconductor market will reach an all-time high in 2026, says SEMI

EP&T Magazine

Electronics Semiconductors Supply Chain semi semiconductors300mm capacity expansion is expected to slow this year due to soft demand for memory, logic devices

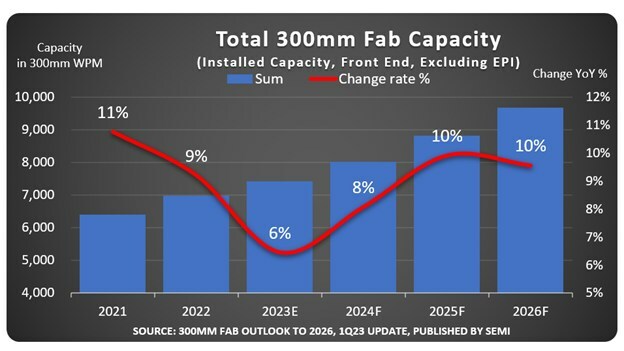

Semiconductor manufacturers worldwide are forecast to increase 300mm fab capacity to an all-time high of 9.6 million wafers per month (wpm) in 2026, SEMI said in its 300mm Fab Outlook to 2026 report.

After strong growth in 2021 and 2022, the 300mm capacity expansion is expected to slow this year due to soft demand for memory and logic devices.

Increase 300mm fab capacity

“While the pace of the global 300mm fab capacity expansion is moderating, the industry remains squarely focused on growing capacity to meet robust secular demand for semiconductors,” said Ajit Manocha, President and CEO, SEMI. “The foundry, memory and power sectors will be major drivers of the new record capacity increase expected in 2026.”

Chipmakers expected to increase 300mm fab capacity during the 2022 to 2026 forecast period to meet growth in demand include GlobalFoundries, Hua Hong Semiconductor, Infineon, Intel, Kioxia, Micron, Samsung, SK Hynix, SMIC, STMicroelectronics, Texas Instruments, TSMC and UMC. The companies are planning 82 new facilities and lines to start operations from 2023 to 2026.

Total 300mm Fab Capacity. source: SEMI

Due to U.S. export controls, China will continue to focus government investments on mature technology to lead in 300mm front-end fab capacity, increasing its global share from 22 per cent in 2022 to 25 per cent in 2026, reaching 2.4 million wafers per month, the SEMI 300mm Fab Outlook to 2026 shows.

Korea’s worldwide 300mm fab capacity share is expected to slip from 25 per cent to 23 per cent from 2022 to 2026 on weak demand in the memory market. Taiwan is on track to retain third place despite a slight dip in share from 22 per cent to 21 per cent during the same period, while Japan’s share of worldwide 300mm fab capacity is also expected to edge down, from 13 per cent last year to 12 per cent in 2026, as competition with other regions increases.

300mm front-end fab capacity

Driven by strong demand in the automotive segment and government investment, the Americas and Europe and Mideast are expected to see 300mm fab capacity share growth from 2022 to 2026. The Americas’ global share is forecast to rise 0.2 per cent to nearly 9 per cent by 2026, while Europe and Mideast is projected to increase its capacity share from 6 per cent to 7 per cent and Southeast Asia is expected to maintain its 4 per cent share of 300mm front-end fab capacity during the same period.

The SEMI 300mm Fab Outlook to 2026 shows analog and power leading other sectors in capacity growth at a 30 per cent CAGR from 2022 to 2026, followed by foundry at 12 per cent, opto at 6 per cent and memory at 4 per cent.

The latest update of the SEMI 300mm Fab Outlook To 2026, published on March 14, lists 366 facilities and lines – 258 in operation and 108 planned for the future.