Component sales sentiment sustains positive growth outlook

EP&T Magazine

Electronics Supply Chain components distribution electronic supply ChainECIA releases sales trend for Q2 2022 in North America

Sales of electronic components continue to show positive growth expectations across North America despite strong economic headwinds, according to the results of a summary report for May produced by industry association Electronic Components Industry Association (ECIA).

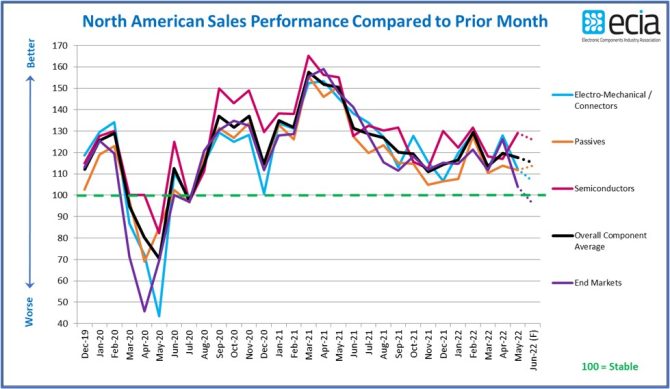

“The overall average sales sentiment for May registered at 117.6, six points above the outlook projected last month,” says Dale Ford, chief analyst, ECIA. “Over the past nine months, starting in September 2021, overall average sales sentiment has tracked within a nine-point range of 111 to 120 except for February when it surged up to nearly 130.”

The ECIA conducts a monthly survey of electronic component manufacturers, manufacturer reps and distributors, which produces the Electronic Component Sales Trend Survey (ECST).

The ECIA conducts a monthly survey of electronic component manufacturers, manufacturer reps and distributors, which produces the Electronic Component Sales Trend Survey (ECST).

Electronic Component Sales Trends

The report shows all major component categories have achieved solid, positive sales sentiment during this time with Semiconductors demonstrating the highest overall sentiment of 123.1 and Passives coming in with the lowest average of 112.5 – less that ten points separating the highest and lowest. The medium-term outlook measured by the Quarterly ECST paints a solidly positive picture through Q3 of this year. Over half of respondents reported expectations of growth in Q2 and Q3 with roughly 25% expecting growth above 3%.

The complete ECIA Electronic Component Sales Trends (ECST) Report is delivered to all ECIA members as well as others who participate in the survey. All participants in the electronics component supply chain are invited and encouraged to participate in the report so they can see the highly valuable insights provided by the ECST report. The return on a small investment of time is enormous.

The monthly and quarterly ECST reports present data in detailed tables and figures with multiple perspectives and covering current sales expectations, sales outlook, product cancellations, product decommits and product lead times. The data is presented at a detailed level for six major electronic component categories, six semiconductor subcategories and eight end markets. Also, survey results are segmented by aggregated responses from manufacturers, distributors, and manufacturer representatives.