The rise of the carbon nanotube battery

By Dr. Richard Collins, principal analyst, IDTechEx Cambridge, UK

Electronics Power Supply / Management Engineering battery CNT graphene powerGraphene’s older sibling progresses beyond the hype & disillusionment phases of its commercial journey

It is impossible to avoid headlines about the ‘graphene battery’; the concept of this Nobel Prize winning nanomaterial revolutionizing the energy storage market is naturally very enticing. Graphene could play a role as an enabling material for next generation batteries, there is lots of promising R&D and industrial activity to support this, but it is graphene’s older sibling carbon nanotubes that have progressed beyond the hype and disillusionment phases of their commercial journey by finding a value-add high volume energy storage adoption. A ‘CNT battery’ is not popular branding nor headline news, it is the everyday commercial reality.

The lithium-ion battery market is skyrocketing. IDTechEx forecast that the demand from electric vehicles (across land, sea, and air, but predominantly for cars) will approach 5,000GWh within a decade from under 500GWh today. A large proportion of the cost, performance and safety are linked with the battery; naturally making it a huge source of innovation and media attention.

Dr. Richard Collins, principal analyst, IDTechEx Cambridge, UK

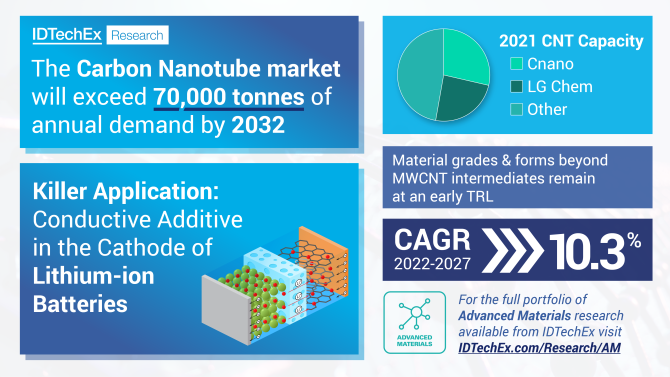

The CNT market is expected to exceed 70ktpa by 2032, a remarkable increase from where we are today. This far outstrips current capacity, which will need to be scaled accordingly, the start of which is already being observed. This is a very high figure but to put this in context the carbon black market comfortably exceeds 10 million tonnes per year (specialty carbon black is the fairer comparison, but this segment is still orders of magnitude larger than this forecast figure). The carbon black market is important to consider not only as a competitive incumbent conductive carbon additive, but also as a case study for a more mature market with a consolidated number of players, global production, and considerably smaller margins.

The upcoming success is attributed to the use of MWCNTs as a conductive additive in the cathode for lithium-ion batteries. This is introduced as a slurry with other additives, the amount of loading depending on the active material, and price-performance considerations. The nanotubes are used for their excellent conductive and mechanical properties with an advantageous 1D morphology. There are numerous advantages including the potential to use thicker electrodes, operate at higher C-rates, and many more.

Source: IDTechEx – “Carbon Nanotubes 2022-2032: Market, Technology, Players”

This success is clearly being seen through the market activity. The largest company, Cnano, have numerous ties to battery manufacturers, particularly in China, LG Chem is scaling production for both LG Energy Solution and beyond, Cabot Corporation acquired SUSN citing the role of CNTs in battery applications, and Toyocolor announced in 2021 they will supply into SK Innovation. There are countless other players including notable Korean companies of JEIO and Kumho Petrochemical who stated to IDTechEx that they are planning expansions. The days of the MWCNT start-ups are gone.

Making progress in anode improvements

It cannot be overstated that not all CNTs are the same and the energy storage landscape is still rapidly evolving. Before this generation of lithium-ion batteries has reached maturity, new generations and disruptive technologies appear on the horizon. This ranges from the short-to-mid-term upcoming adoption of silicon anodes, the expected longer-term successes in solid state batteries, and the likes of Li-S and Li-air still needing a stepwise improvement. Then there is beyond lithium-ion, e.g. Na-ion, and into supercapacitors.

Then there is the opportunity beyond MWCNTs in the cathode. Single-walled carbon nanotubes continue to explore the energy storage space with the likes of OCSiAl, particularly with the new 2021 investor Daikin Industries, Zeon Corporation, and Zeta Energy making announcements here. There are also hybrid products, such as CB-CNT developments by Birla Carbon and CHASM Advanced materials, making progress in anode improvements. Vertically aligned CNTs (VACNTs) are making progress in ultracapacitors with an eye for battery applications, most notably shown by Nawa Technologies.

Finally, there is also the geopolitical backdrop that cannot be ignored. This not only influences the battery material market and subsequent design choices but is also having notable supply chain implications.