Automotive semiconductor industry surges

EP&T Magazine

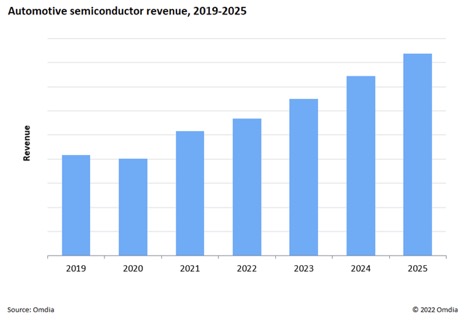

Electronics Semiconductors Supply Chain automotive semiconductorMarket sees a rise of 12.3% CAGR through 2025, says Omdia report

The automotive semiconductor industry is set to surge at a compound annual growth rate (CAGR) of 12.3% through 2025 on the heels of a strong comeback from the pandemic, according to a new report from research and consulting firm Omdia.

Semiconductor content in automobiles has been increasing steadily for the past decade, but several recent trendlines have combined to accelerate automotive semiconductor revenues, Omdia’s report shows.

Those trends include rising sales of battery electric vehicles (BEVs) and growing demand for advanced driver assist systems (ADAS) and infotainment & telematics (I&T) systems, according to Sang Oh, Senior Research Analyst for automotive semiconductors at Omdia and author of the market tracker report.

“The average BEV creates 2.9 times more semiconductor revenue than a vehicle with a traditional internal combustion engine,” Oh said. “In addition, ADAS applications like camera modules for park assistance and collision warning, plus I&T applications like the transition from analog or hybrid instrument clusters to digital clusters, are also driving increased semiconductor content.”

Bouncing back from pandemic

COVID-19 dealt a significant blow to the global automotive semiconductor industry in the first half of 2020 as global vehicle production ground to a halt during the early days of the pandemic. But the industry posted a strong rebound beginning in 3Q20.

The sector’s recovery accelerated in 2021, with total annual revenues hitting a projected $51.6 billion, up 28.6% from the prior year. This came at a time when the automotive supply chain overall continued to experience disruption, and global vehicle production grew a relatively small 2.5% in 2021 against the prior year.

Report covers 30 semiconductor device types

“The much stronger recovery in the automotive semiconductor market than we see in the industry as a whole can be attributed to the dramatic increase in average selling prices for auto semis as supplies became constrained, as well as the trend for electronics manufacturers to pre-order and increase their inventories and safety stocks,” explained Oh.

The Automotive Semiconductor Market Tracker summarizes the auto semis industry and provides information to help industry players better understand and forecast upcoming trends. The report covers 30 separate semiconductor device types used across more than 49 different primary vehicle electronic applications. The tracker is built using vehicle production and electronic module fitment projections.

—————-

For more information about the Omida report, visit Automotive Semiconductor Market Tracker – 2H21 Analysis.