North American distribution component sales up 2.2%: ECIA report

EP&T Magazine

Electronics Engineering Supply Chain component sales distribution distribution distyDistributor component sales for North America showed solid growth again in the fourth quarter of 2017, as sales improved 2.2% over the previous year period, according to a report from ECIA. Book to Bill was a strong 1.1 through 2017, while distributor component sales totaled $14.5 billion.

Quarterly percent change and year on year change by product category are included in the chart below.

| Q4′ 17 | Q4′ 17 | ||||

| v.s. Q4′ 16 | v.s. Q3 17 | 2017\2016 | |||

| % Change | % Change | % Change | |||

| Interconnect Products | 8.2% | 1.6% | 2.0% | ||

| Passive Products | 11.5% | 4.3% | 11.5% | ||

| Semiconductor Products | 19.1% | 2.3% | 13.1% | ||

| Electromechanical Products | 10.4% | 0.2% | 10.0% | ||

| Displays | -6.8% | -1.3% | -0.9% | ||

| Total Distributor Sales | 16.1% | 2.2% | 10.4% |

Passive component sales saw the strongest growth coming from capacitor sales, followed closely by resistor sales. The strongest sector of the semiconductor market was analog, followed by digital and logic. Electromechanical sales were driven by relays, followed by switches.

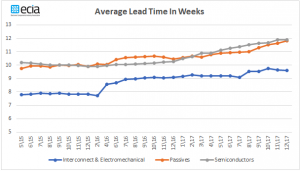

Distributors remain positive that growth will continue well into 2018. The only concern noted was the impact of extended lead times of key components on their ability to support customer demand at least through the first half of 2018. The chart below shows average lead time trends by the major product categories.

Semiconductor lead times remain extended but should remain stable for the next 90 days per ECIA semiconductor member companies. While capacity is being added, demand is stripping away the ability to bring lead times in. Shortages are broad based and impacting all semiconductor suppliers, regardless of product type and they do not see this changing, at least for the first half of 2018. Passive component lead times have continued to increase with many commodity passive products on allocation. Strong growth is especially coming from the automotive segment and with the 2018 requirements now hitting customer forecasts, further strain is being placed on the supply chain. With growth projected in other key market segments, most distributors anticipate constrained capacity well into 2018. For non-commodity passives, lead times have extended but not like commodity passives. Non-commodity passives suppliers expect to see extended lead times, where they do exist, through the middle of 2018 at a minimum. Key market segment drivers for these products are transportation and the industrial markets. Interconnect products and Electromechanical product lead times did extend 2 to 4 weeks over the last half of 2017 but currently are stable. Distributors see growth continuing in 2018 for these products especially in the transportation and defense market segments with some growth coming from the industrial segment as well.